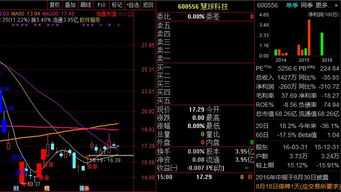

Title: Exploring the Potential of Huqiu Technology Stocks

In the dynamic world of stock market investments, it's crucial to carefully evaluate companies before making investment decisions. Huqiu Technology, like any other stock, requires thorough analysis to understand its potential for growth and its risks. Let's delve into the key aspects surrounding Huqiu Technology stocks:

Understanding Huqiu Technology:

Huqiu Technology is a renowned player in the technology sector, known for its innovative solutions and products. To assess its stock's potential, we need to examine various factors:

1.

Company Profile:

Begin with understanding the company's history, its mission, and its core products or services. Look into its leadership team, its financial health, and its market positioning.

2.

Industry Analysis:

Evaluate the sector in which Huqiu operates. Is it a growing industry with high demand? What are the current trends and future projections? Understanding the industry dynamics helps in assessing Huqiu's growth potential.3.

Financial Performance:

Analyze Huqiu's financial statements, including its revenue growth, profitability, and cash flow. Look for consistent growth patterns and stability in earnings.4.

Competitive Advantage:

Determine if Huqiu has a competitive edge over its rivals. This could be through patented technology, strong brand recognition, or superior customer service.5.

Market Share and Expansion Plans:

Assess Huqiu's market share compared to its competitors. Additionally, explore its strategies for expanding into new markets or diversifying its product/service offerings.Evaluating Huqiu Technology Stocks:

1.

Technical Analysis:

Utilize technical indicators like moving averages, relative strength index (RSI), and MACD to analyze the stock's price trends and identify potential entry or exit points.2.

Fundamental Analysis:

Conduct a thorough examination of Huqiu's fundamentals, including its pricetoearnings ratio (P/E), earnings per share (EPS), and book value. Compare these metrics with industry averages and competitors.3.

Risk Assessment:

Identify and assess various risks associated with investing in Huqiu stocks. These may include market volatility, regulatory risks, and companyspecific challenges.4.

Investment Horizon:

Determine your investment horizon and risk tolerance. Are you looking for shortterm gains or longterm growth? Your investment strategy should align with your financial goals.5.

Diversification:

Consider incorporating Huqiu stocks into a diversified investment portfolio. Diversification helps mitigate risk by spreading investments across different assets or sectors.Conclusion and Recommendations:

Investing in Huqiu Technology stocks can be rewarding but requires thorough research and analysis. Consider consulting with a financial advisor or conducting further due diligence before making investment decisions. Remember to stay updated with the latest market trends and news related to Huqiu and the technology sector.

Disclaimer:

The information provided here is for educational purposes only and should not be considered as financial advice. Investing in stocks involves risk, and individuals should perform their own research or consult with a professional financial advisor before making investment decisions.This analysis provides a comprehensive overview of Huqiu Technology stocks, aiding investors in making informed decisions regarding their investment strategies.